Bulletproof Your Investments: Discovering the Best Crypto Exchange for Security

Table of Contents

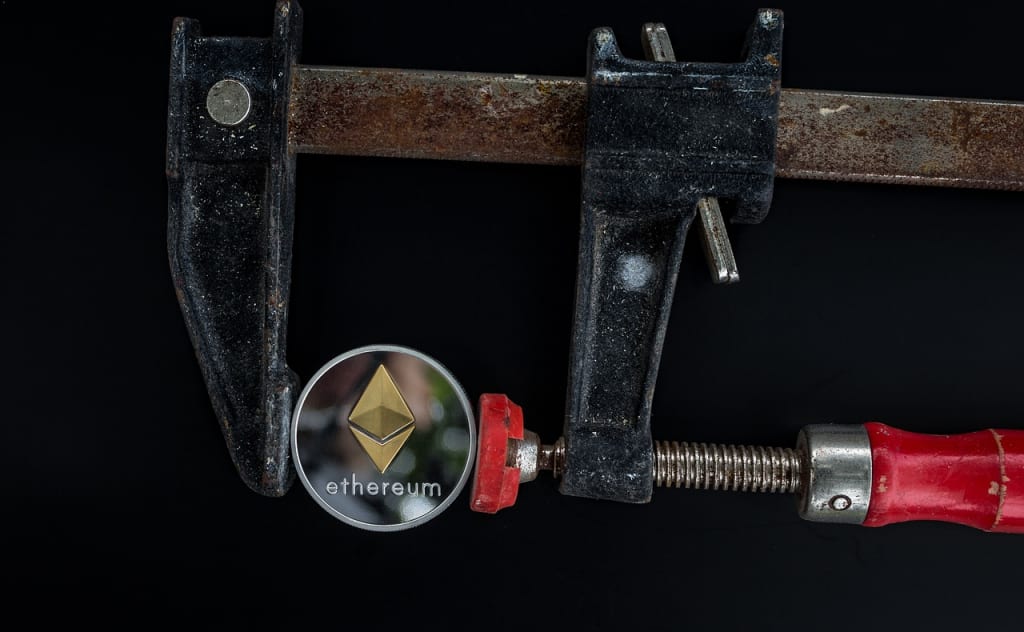

Understanding Crypto Exchange Security

As we delve into the world of cryptocurrency, it's paramount to recognize the significance of security on digital asset platforms. Here at Crypto Investment HQ, we've seen firsthand how the landscape of crypto exchanges has evolved, and we can't stress enough the importance of selecting the best crypto exchange for security for your investments.

Importance of Exchange Security

Exchange security is the cornerstone of a trustworthy and reliable platform for trading digital currencies. It ensures that your hard-earned assets are protected against unauthorized access and cyber threats. We've all heard the horror stories of investors losing their investments overnight due to lax security measures, and we want to ensure that you're not next in line.

Security on crypto exchanges encompasses a range of measures, from two-factor authentication (2FA) to end-to-end encryption, designed to safeguard your account and transactions. It's not just about keeping your funds secure, but also about protecting your personal information from being compromised. As your guides in the crypto space, we're here to help you navigate toward exchanges that prioritize robust security protocols.

Risks Associated with Crypto Exchanges

Despite the best efforts of many platforms, risks still loom in the crypto exchange landscape. On-chain vulnerabilities have driven the majority of DeFi hacking activity in 2023, with compromised private keys, price manipulation hacks, and smart contract exploitation being significant contributors to losses.

| Risk Factor | Description |

|---|---|

| Compromised Private Keys | Unauthorized access to private keys can lead to loss of funds. |

| Price Manipulation | Hackers can artificially inflate or deflate asset prices to their advantage. |

| Smart Contract Exploitation | Flaws in contract code can be exploited to siphon funds. |

Custodial wallets, like those managed by exchanges such as Coinbase, have been targets of attacks, leading to the implementation of enhanced security measures. It's become clear that relying solely on exchange-provided wallets may not be sufficient, which is why we advocate for the use of cold storage options to further bulletproof your investments.

In the following sections, we'll discuss best practices for securing your crypto assets, recent hacking incidents to learn from, and we'll provide our insights on the safest crypto exchanges across various regions, including the US, Canada, India, and more. We'll also guide you through choosing the right exchange that aligns with your needs, whether you're looking for the best crypto exchange for beginners or the best platform for trading altcoins. Stay tuned as we explore how to protect against cyber threats and ensure your investments remain secure in the ever-evolving crypto ecosystem.

Factors Influencing Exchange Security

As we navigate the complex landscape of digital currencies at Crypto Investment HQ, we emphasize the critical importance of exchange security. Our collective experience has shown us that security is a paramount factor when looking for the best crypto exchange for security. Let's explore the on-chain vulnerabilities that pose risks to exchanges and the security measures that can fortify them against threats.

On-chain Vulnerabilities

On-chain vulnerabilities have been a driving force behind the majority of DeFi hacking activity in the past year. Compromised private keys, price manipulation hacks, and smart contract exploitation have led to significant financial losses. For example, North Korea-linked hackers were responsible for stealing approximately $428.8 million from DeFi platforms in 2023 by exploiting these on-chain weaknesses.

These vulnerabilities underscore the intrinsic risks associated with the blockchain technology underpinning crypto exchanges. It is crucial for exchanges to address these issues to ensure the integrity of transactions and the safety of user assets.

| Vulnerability Type | Description | Notable Incidents |

|---|---|---|

| Compromised Private Keys | Unauthorized access to private keys allowing theft of funds | Multiple instances across various platforms |

| Price Manipulation | Exploiting market vulnerabilities to alter asset prices | DeFi platform hacks |

| Smart Contract Exploitation | Taking advantage of code loopholes in smart contracts | North Korea-linked hacks |

Security Measures in Place

To combat these on-chain vulnerabilities, robust security measures must be in place. Cryptography is at the heart of cryptocurrency security, protecting information and communication to ensure that only authorized users can access and transact. During a transaction, for instance, a unique hash generated by the sender's wallet is transmitted along with encrypted details of the recipient's address and the transaction amount, all signed with the sender's private key.

Here at Crypto Investment HQ, we advise platforms to adopt multiple layers of security, including but not limited to:

- Two-factor authentication (2FA)

- Secure wallet protocols

- Advanced encryption techniques

- Comprehensive network security strategies

- The creation of strong, unique passwords

- Rigorous access control systems

- Ongoing monitoring and regular audits

Moreover, partnering with reliable security vendors like Arkose Labs can significantly enhance a platform's defense against cyber threats. Arkose Labs specializes in protecting cryptocurrency platforms from automated bot attacks by presenting targeted friction challenges to suspicious users. These challenges are purposefully designed to be difficult for bots, scripts, and automated solvers, thereby safeguarding platforms from exploitation.

For further details on how to secure your digital assets, explore our comprehensive guides on best crypto exchange for beginners and best crypto exchange for trading.

Ensuring the security of crypto exchanges is a multifaceted endeavor, requiring constant vigilance and adaptation to new threats. By understanding the factors influencing exchange security, we can take proactive steps to protect our investments and maintain trust in the digital currency ecosystem.

Best Practices for Securing Crypto Assets

Securing crypto assets is a fundamental aspect of engaging in the digital currency landscape. As your Crypto Investment HQ, we're here to guide you through the best practices for keeping your investments safe.

Importance of Cold Wallets

Cold wallets, or cold storage solutions, are essential for anyone serious about crypto security. These wallets are not connected to the internet, significantly reducing the risk of cyber attacks and unauthorized access. We recommend using commercial non-custodial cold wallets like the Ledger Nano X or Trezor Model T, which act as USB connection-type drives. They come with their accompanying software that allows you to manage your holdings securely without exposing your private keys. Remember, storing private keys offline in such cold storage devices is a critical step in safeguarding your crypto assets.

Multi-Signature Wallets

Another layer of security can be added with multi-signature wallets. This approach involves transaction approval from multiple people, which means no single individual has full control over the wallet. Each transaction requires approval from several designated individuals, thus limiting the risk of theft and adding a collective responsibility aspect to asset management. Multi-signature wallets are particularly useful for organizations or groups where funds need to be accessed by multiple parties.

Utilizing Seed Phrases

Seed phrases are akin to the master password for your crypto wallet. A seed phrase is a series of randomly generated words that act as a backup to access your wallet. In the unfortunate event of device loss or failure, the seed phrase enables you to recover your keys and, consequently, your assets. It's crucial to store your seed phrase securely. Some investors go to the length of using titanium stamping kits to physically record their phrases, ensuring durability and resilience against physical damage.

By adopting these best practices, you are taking proactive steps to ensure the security of your crypto assets. Whether you're looking for the best crypto exchange for beginners or an advanced platform for trading, remember that the safety of your investments should always be a top priority. Explore our resources to find the best crypto exchange for security and learn more about safeguarding your digital wealth.

Recent Crypto Exchange Hacks

At Crypto Investment HQ, we always emphasize the importance of security when choosing the best crypto exchange for security. Despite the best efforts, the unfortunate reality is that crypto exchanges can be vulnerable to hacks. Let's take a closer look at some of the most notable security breaches that have shaken the crypto world.

FTX Exchange Hack

In November 2022, the crypto community was shocked when FTX, one of its most prominent exchanges, declared bankruptcy following a massive security breach. More than $600 million was stolen from its wallets, leaving many users staring at $0 balances. FTX confirmed the hack on its Telegram channel, cautioning users to uninstall any FTX apps as they might contain malware. This incident highlights the stark risks associated with digital currency platforms and the need for stringent security measures.

| Exchange | Date | Amount Stolen |

|---|---|---|

| FTX | November 2022 | $600 million |

Binance Exchange Hack

In October 2022, Binance, another leading name in the crypto exchange landscape, fell victim to a hack amounting to $570 million. Attackers exploited the BSC Token Hub cross-chain bridge due to a smart contract vulnerability, enabling them to create and withdraw 2 million Binance Coins (BNB). This event underscores the critical need for robust on-chain security protocols to prevent such exploits.

| Exchange | Date | Amount Stolen |

|---|---|---|

| Binance | October 2022 | $570 million |

Coincheck Theft Incident

The Coincheck exchange experienced one of the most significant thefts in crypto history. In January 2018, hackers absconded with $523 million worth of NEM coins, valued at approximately $534 million at the time. The breach was largely due to the use of a hot wallet, which is notably less secure than cold storage options. This monumental loss served as a wake-up call for exchanges to prioritize security, especially in their wallet infrastructure.

| Exchange | Date | Amount Stolen |

|---|---|---|

| Coincheck | January 2018 | $534 million |

These security breaches serve as important lessons for us and our community. When we discuss finding the best crypto exchange for trading or the best crypto exchange for beginners, the conversation must always include a discussion on security. It's a reminder that even the most reputable platforms can be compromised and the importance of using cold wallets and multi-signature wallets for enhanced security of our digital assets.

Safest Crypto Exchanges

As your go-to Crypto Investment HQ, we understand the importance of security when it comes to choosing a crypto exchange. We've taken the time to research and vet various platforms to ensure that we provide you with trustworthy advice on the best crypto exchange for security. Here are our top picks for the safest crypto exchanges that stand out for their robust security measures and commitment to protecting your digital assets.

Bitget Exchange

Since its launch in 2018, Bitget has established itself as one of the safest cryptocurrency exchanges in the industry. With a clean track record of no hacks, Bitget offers peace of mind alongside its advanced trading features. Boasting a diverse portfolio of 700 crypto assets and over 1,000 tradeable pairs, Bitget caters to both beginners and seasoned traders.

| Feature | Detail |

|---|---|

| Security Highlights | No hacks since launch |

| Crypto Assets | 700+ |

| Tradeable Pairs | 1,000+ |

| Advanced Features | Yes |

One of the key reasons we recommend Bitget is due to its high-quality security measures. By prioritizing the safety of users' funds, Bitget has demonstrated its commitment to creating a secure trading environment. For more on Bitget and its offerings, check out our best crypto exchange for trading.

Coinbase Exchange

Coinbase, known for its user-friendly interface, is a publicly traded cryptocurrency exchange that has become a household name in the United States. While it has experienced some security breaches in the past, Coinbase continues to evolve its security protocols to protect its users' investments.

| Feature | Detail |

|---|---|

| User-Friendly | Yes |

| Publicly Traded | Yes |

| Security Breaches | Historical incidents |

| Available | United States |

As a beginner-friendly platform, Coinbase provides an accessible entry point for those new to the world of crypto. We recommend staying informed about the latest security updates and utilizing all available security features offered by Coinbase. Beginners can find more guidance in our best crypto exchange for beginners.

Kraken Exchange

Kraken has forged a reputation for not only low transaction fees but also for its rigorous security measures. Known for conducting regular audits and offering features like Proof of Reserves, Kraken prioritizes the safety of users' funds and personal data. Kraken Pro, in particular, is recognized for its robust security among cryptocurrency exchanges.

| Feature | Detail |

|---|---|

| Low Transaction Fees | Yes |

| Regular Audits | Yes |

| Proof of Reserves | Offered |

| Kraken Pro | Highly secure platform |

For those of you who are security-conscious and looking for a reliable exchange with competitive fees, Kraken is an excellent choice. Explore Kraken's security features and learn how to safeguard your investments on our best crypto exchange for security.

In conclusion, while we've highlighted these exchanges for their security, we encourage you to consider your specific needs and preferences when choosing the right exchange. Each platform has its strengths, and it's crucial to compare their security features before making a decision. For a more in-depth comparison, visit our guide on comparing security features across different exchanges. Your digital asset security is paramount, and with the right exchange, you can invest with confidence.

Choosing the Right Exchange

When we are on the lookout for the best crypto exchange for security, we have to be meticulous about the factors we consider. It's not just about finding a place to trade; it's about ensuring the safety of our investments. Let's explore the key considerations and compare the security features of some leading exchanges.

Factors to Consider

When selecting a crypto exchange, we must weigh various factors to ensure we're making a secure choice. Here are some we always look at:

- Security Protocols: Does the exchange employ industry-leading security measures such as SSL encryption, two-factor authentication, and cold storage for funds?

- Regulatory Compliance: Is the exchange compliant with global financial regulations, including anti-money laundering (AML) and know your customer (KYC) policies?

- Insurance and Asset Protection: Does the exchange have an insurance policy in place to protect users' assets against potential breaches or hacks?

- Track Record: What is the exchange's history with security breaches or hacks, and how have they responded to such incidents?

- User Reviews and Community Trust: What do other users say about the exchange's security and reliability?

- Fee Structure: Are the fees reasonable, and do they align with the security measures provided?

- Customer Support: In case of issues, how effective and responsive is the exchange's customer support?

Comparing Security Features

To give you a clearer picture, we've compared the security features of three well-regarded exchanges: Coinbase, Kraken, and Bitstamp.

| Exchange | Security Protocols | Regulatory Compliance | Insurance Policy | Track Record | Fees |

|---|---|---|---|---|---|

| Coinbase | 2FA, SSL, Cold Storage | High | Up to $250,000 | Excellent for beginners | Varies based on trade |

| Kraken | 2FA, SSL, Cold Storage | High | Not specified | No large-scale hack since 2011 | 0.00% to 0.26% |

| Bitstamp | 2FA, SSL, Cold Storage | High | Not specified | High | 0.00% to 0.50% |

As we see, Coinbase (best crypto exchange for beginners) stands out with its insurance policy and ease of use. Kraken (best crypto exchange for trading) is known for its robust security and advanced features. Bitstamp is recognized (anonymous crypto exchange with low fees) for its competitive fees and strong cybersecurity measures.

Ultimately, the best exchange for you will align with your individual needs, whether you're looking for simplicity, advanced features, low fees, or a particular type of security measure. Take the time to research and compare the options, and consider trying out the platforms to find the one that feels most secure and user-friendly for you. Remember, the safety of your crypto assets should always be top priority.

Regulatory Impact on Exchanges

Navigating the landscape of cryptocurrency exchanges can be daunting, especially when considering the regulatory impact on these platforms. As your Crypto Investment HQ, we understand the importance of staying informed about the latest enforcement actions and compliance requirements. Let's delve into how regulatory bodies like the SEC are influencing the crypto exchange arena.

SEC Enforcement Actions

In recent years, the Securities and Exchange Commission (SEC) has intensified its scrutiny of the cryptocurrency space. In 2023 alone, the SEC took a significant number of cryptocurrency enforcement actions, following high-profile bankruptcies and platform collapses. These actions serve as a stern reminder of the risks associated with digital currencies and the need for robust regulatory frameworks.

The SEC's focus has been on anti-fraud and securities regulations, targeting exchanges that may not have fully complied with existing laws. For instance, the SEC Chair Gary Gensler has pointed out that major crypto exchanges are likely trading assets that could be classified as securities and, as such, should be registered with the SEC. This push for registration indicates an upcoming wave of enforcement that could redefine the operations of many exchanges.

| Year | Number of SEC Enforcement Actions |

|---|---|

| 2023 | 26 |

For more insights into how the SEC's enforcement actions are shaping the crypto exchange landscape, check out our article on best crypto exchange for compliance.

Compliance with Regulations

For exchanges, compliance with regulations is not optional; it's a necessity to ensure the security and stability of their operations. Exchanges must adhere to a complex set of guidelines that govern everything from the listing of new tokens to the execution of customer transactions.

The SEC has expanded its efforts to oversee the crypto market by increasing the size of its Cyber Unit by 66% in 2022, rebranding it as the Crypto Assets and Cyber Unit. This expansion is a clear signal of the SEC's commitment to policing the rapidly evolving digital asset space. Key concerns for the SEC include the prevention of fraud and manipulation, which can severely harm investors and undermine the integrity of the market.

As investors, our due diligence should include an examination of an exchange's compliance with regulatory standards. Exchanges that prioritize regulatory adherence are often more trustworthy and provide a safer environment for our investments. To explore exchanges that excel in upholding regulatory standards, take a look at our guides for various regions, such as best crypto exchange us, best crypto exchange uk, best crypto exchange canada, and best crypto exchange india.

In summary, the regulatory landscape is a crucial aspect of the crypto exchange world. As part of our mission at Crypto Investment HQ, we aim to guide you through these complexities and help you find the best crypto exchange for security, ensuring your investments are not only profitable but also protected.

Crypto Privacy Concerns

In the world of cryptocurrency, privacy is a nuanced topic that often pits transparency against the individual's right to privacy. As Crypto Investment HQ, we understand the concerns our users have regarding privacy and the visibility of their transactions.

Transparency vs. Privacy

Cryptocurrency was designed with the intention of creating a transparent financial system. Each transaction is documented in blocks that are interconnected using cryptography, forming a blockchain. This ensures a high level of security and transparency, as all transaction histories are permanently stored and can be viewed by anyone.

However, this level of transparency can be a double-edged sword. While it allows for increased trust and reliability in transactions, it can also reveal patterns that, over time, may be linked back to the individuals behind the public keys. Here at Crypto Investment HQ, we encourage our users to balance their need for transparency with their right to privacy.

| Aspect | Transparency | Privacy |

|---|---|---|

| Transaction History | Publicly visible | Pseudonymous |

| Trust and Reliability | Increased | Variable |

| Potential for Linking to Individual | High | Lowered with precautions |

Pseudonymity in Transactions

Cryptocurrency transactions offer pseudonymity, meaning that each participant has a public key that acts as an address and a private key that serves as a digital signature. While personal identities are not directly attached to these keys, the public nature of the transaction ledger allows for the possibility of analysis that could eventually link behaviors to individuals.

At Crypto Investment HQ, we guide our users to make informed decisions about their transactions to help maintain their privacy. Pseudonymity can be enhanced by using different addresses for transactions and considering the use of privacy-focused cryptocurrencies or additional privacy services.

It's important to note that while these measures can increase privacy, they may not always align with the requirements of regulated exchanges. Therefore, we also provide guidance on how to navigate exchanges that prioritize privacy without compromising on security, such as anonymous crypto exchanges with low fees and no kyc crypto exchanges with fast withdrawal.

In summary, as the digital currency landscape continues to evolve, so too do the conversations around privacy. At Crypto Investment HQ, we remain committed to providing our users with the knowledge and tools to secure their investments while respecting their desire for privacy. Whether you're looking for the best crypto exchange for beginners or the best crypto exchange for privacy, we are here to help you navigate these complex waters with confidence.

Protecting Against Cyber Threats

In the digital world of cryptocurrencies, the security of exchanges is paramount. At Crypto Investment HQ, we understand that protecting your digital assets against cyber threats is a top priority. Here we'll discuss how cybercriminals exploit vulnerabilities and the importance of implementing Data Loss Prevention strategies.

Cybercriminal Exploitation

Cybercriminals are continuously seeking ways to exploit vulnerabilities within crypto exchanges. These nefarious actors use a variety of tactics, including phishing, malware, and social engineering, to gain unauthorized access to user accounts and wallets. As a result, robust security measures are not just recommended but essential.

Cryptocurrency security standards, known as Cryptocurrency Security Standards (CCSS), play a critical role in safeguarding your investments. These standards encompass a comprehensive approach to security, addressing aspects such as key generation, wallet creation, and transaction verification. By following CCSS guidelines, exchanges can mitigate risks and enhance the integrity of their platforms.

Moreover, reliable security vendors like Arkose Labs provide critical defense mechanisms against automated bot attacks. By introducing targeted friction challenges that are difficult for bots and scripts to bypass, Arkose Labs helps to shield both the exchange and its users from potential exploitation.

Implementing Data Loss Prevention

Data Loss Prevention (DLP) is a strategy crucial for safeguarding sensitive data from breaches, unauthorized access, or theft. With the average cost of a data breach in the financial services industry reaching $5.97 million in 2022, and with 82% of breaches caused by human errors, implementing a DLP solution is more than just a security measure—it's a trust-building exercise with your customers.

A robust DLP strategy includes:

- Two-factor authentication (2FA) to add an additional layer of security beyond just a password.

- Regular reviews and audits of security protocols to update and patch any vulnerabilities.

- Encryption techniques to protect data both in transit and at rest.

- Network security measures, including firewalls and anti-malware software.

- Strong passwords and access controls to limit the potential for unauthorized access.

- Continuous monitoring to detect and respond to any unusual activity promptly.

As your partners in crypto investment, we at Crypto Investment HQ encourage you to consider not only the best crypto exchange for security but also the best practices for maintaining the security of your assets. Whether you are looking for the best crypto exchange for beginners or advanced trading platforms, ensure that they align with stringent security measures and offer the tools necessary for you to manage your investments responsibly.

Ethan Reynolds is a passionate advocate for blockchain technology and cryptocurrencies. His journey into the crypto space began during the early days of Bitcoin, where he was captivated by the disruptive potential of decentralized digital currencies.